From February to April 2021 the ProRetro team conducted an online survey among owners of residential buildings. With this survey, we have collected additional data that will help implementing partners design their one-stop-shops. 183 owners of residential buildings have participated in our survey. The respondents are both from the ProRetro project cities and regions (i.e., Berlin, Boeblingen, Bottrop, Hanover and Wuppertal) and other parts of Germany.

Eighty-three percent of respondents answered our questions for a residential building or apartment they own and live in. The other 17 percent responded with respect to a building or apartment they rent out.

One-stop-shops assume responsibility for difficult tasks

The expectations one-stop-shops are supposed to meet are numerous: Refurbishments take owners less time, no tedious search for contractors, better planning and execution of works due to the one-stop-shop’s experience and knowledge. We asked respondents how hard they expect challenges associated with a refurbishment to be. The results confirm that a one-stop-shop addresses relevant challenges: 85% of respondents presume finding reliable contractors to be very or rather hard. Even 87% expect that judging the quality of construction work will be very or rather hard for them. About 77% of respondents anticipate that deciding will be very or rather hard for them if they have no experience with making such decisions. It was remarkable that more than 60% expect it to be very or rather easy to obtain financing. One reason for this might be that interest rates are extraordinarily low at the moment in Germany.

Taken as a whole, respondents have a predominantly good first impression of the idea of a one-stop-shop. Almost 81% answer that they have a positive or very positive first impression of the idea. We asked respondents whether they are willing to delegate certain tasks that come up during a refurbishment to a one-stop-shop. About 81% of respondents are willing to let the one-stop-shop coordinate construction work. Almost as many (80%) are ready to task the one-stop-shop with inspecting the quality of works and allowing it to choose and commission an energy advisor. With 37% answering “Not sure” a considerable share of respondents is unsure whether they would let the one-stop-shop close contracts on their behalf. 28% are unsure about delegating the negotiation of terms and conditions of contracts to the one-stop-shop. Moreover, 26% are not sure if they would permit the one-stop-shop to choose contractors.

The one-stop-shop’s expertise and experience is the most important reason to commission one

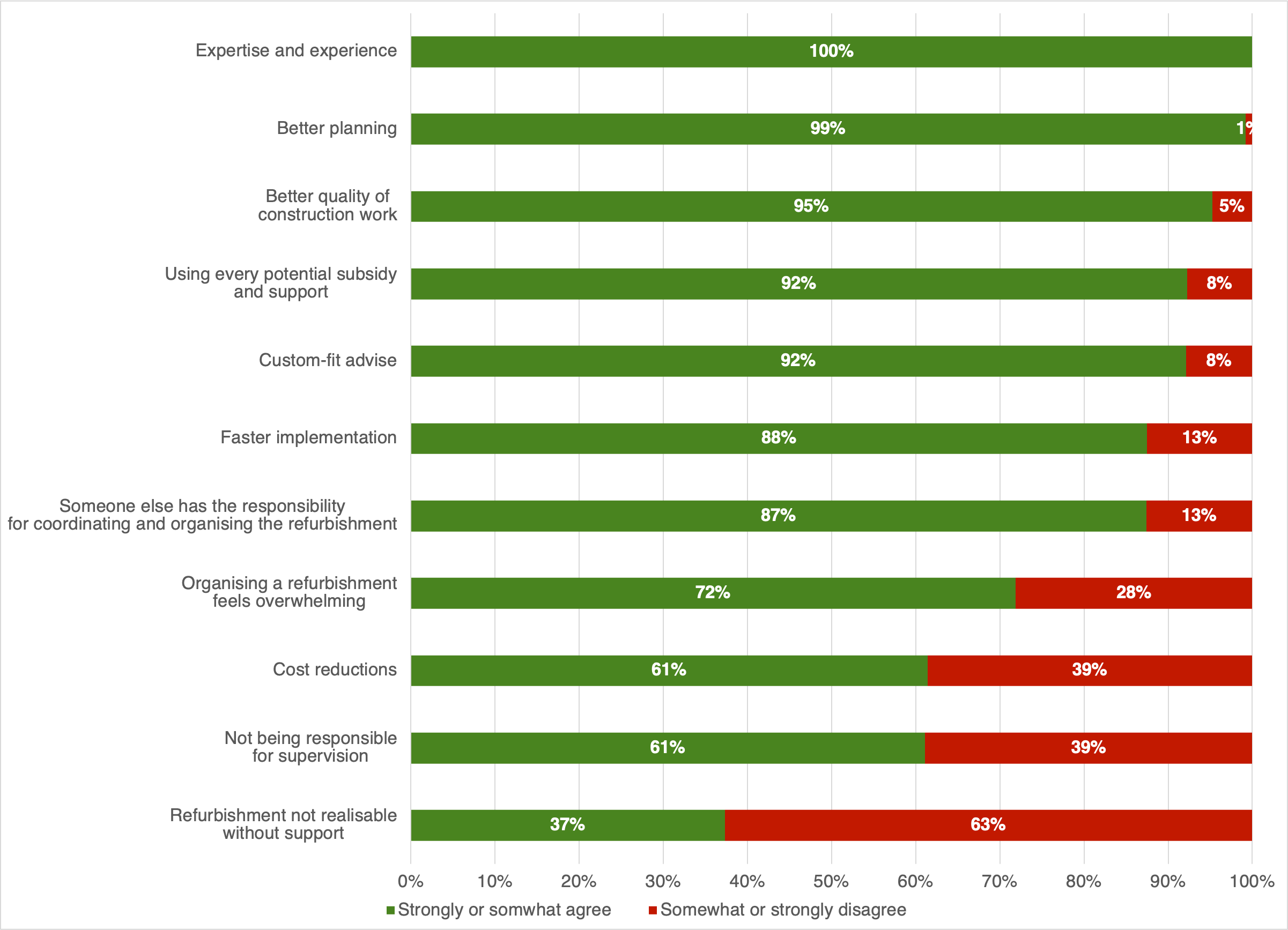

The 130 respondents who can imagine commissioning a one-stop-shop name its expertise and experience as most important reason (100% strongly or somewhat agreeing). Additionally, a large majority of respondents expect the planning (99%) and construction quality (95%) to be better. Furthermore, the possibility to use all available subsidies and support programmes (92%), getting customized advise (92%) and faster implementation (88%) are motivating factors.

The respondents who are not interested in a one-stop-shop’s service name the wish to remain in full control of the process (88%) and the worry that the refurbishment will be more expensive if organised by a one-stop-shop (85%) as reasons.

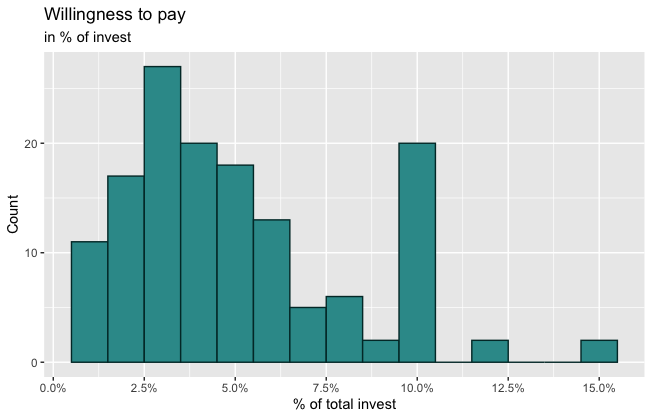

Customers are willing to pay a fee for a one-stop-shop with convincing services

More than 80% of respondents consider it rather or very important that the one-stop-shop offers the following services:

- Identifying qualified contractors,

- advise on subsidies and support programmes,

- supporting the choice of refurbishment measures,

- on-site energy advise,

- the same contact person throughout the refurbishment,

- as well as coordination and organisation of construction work.